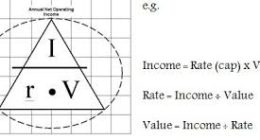

Cap Rate Formula

When you are evaluating commercial property (or any property for that matter), CAP Rate evaluation, can give you a strong comparative analysis. CAP rate measures, the income, price and return of an asset. When you have a couple of the elements, you can always figure out the rest. Therefore, if you know the CAP rate, and price, you automatically can figure to the ROI.You can use CAP rate to compare assets, ensure ROI and even use to negotiate the value (or price).

To calculate the CAP rate you must know, the NOI (Net Operating Income). Essentially, all revenue and expenses, before debt service. Find below a simple summary of revenue and expenses to give you an idea of the income model and NOI.

NOI is revenue, minus expenses, before Debt and Taxes. It is often a good plan to use some sort of evaluation software to see the numbers.

Example: Say the property has an NOI of $10,000, and the price is $100,000.

- CAP rate = NOI/Price (shows a percent/point)

- $10,000/ $100,000 = .1 (or 10 % cap rate)

- Some folks will calculate, as NOI*100/Price=CAP rate

- $10,000*100/ $100,000 = 10 (or 10 % cap rate)

- (1 million)/ $100,000 = 10.

Generally, a good CAP rate is 8, 9 or 10. Therefore, anything below that is not a good deal, and anything above 10 (Great). Like any evaluation tool, there is more than the numbers in a deal. The property above might have more income potential, growth, rent increases, shortage of demand, all of which could increase the NOI. So, an evaluation of the market and potential is needed before blindly putting forth an offer.

You can also, back in to the purchase price, with CAP rate. For example, I must have a CAP rate of 12 or greater. If the NOI on a property is 10k, I know, the purchase price MUST be 80k or less.

CAP rate kind of measures, the income you are receiving for the price (value). Therefore, you can see which deal is better. If I can get a 15 CAP vs a 10 CAP. The 15 brings in more revenue, per dollar capitalized (spent). It does have some limitations.

CAP rate assumes we are paying all cash, and gives us the ability to evaluate deal A against deal B, with out regard to financing and debt servicing. Obviously, financing the deal is an important element. Let us say, we find a deal, but the CAP rate is only 6. Most folks will pass it by, but what if, we have 100% percent selling financing. No cash out of pocket. You would be fool to pass the deal by.

After you get a feel for CAP rate, you must do a cash on cash return, which would include debt servicing.

Brokers are fond of quoting “cap rates.” In my experience, is very important to confirm numbers. Many quotes are false. They (and or the owners), use projections rather than real numbers (or actual revenue and expenses), often skip vacancies, or miss expenses. Best to see the rent rolls, tax returns, or audited results.

When you think about commercial, I suggest you consider, mobile home parks, and Adult living facilities (55 and older). They have much better CAP rates. Sometimes above 15. That is incredible.